As borrowers may fail to pay their debts following the agreed terms, credit risk can sometimes be inevitable for financial institutions. Recent studies show differences across age groups regarding financial needs, particularly in loan applications. For instance, while Millenials may have difficulty establishing themselves financially, early boomers can be the most economically stable and confident in managing their finances.

Smile closes this generational gap by mitigating credit risk. When lenders don’t have enough data to assess their borrowers, higher non-performing loans are evident and, therefore, a struggle for both parties.

Which age range(s) are good-paying borrowers, and which are not?

Those in their thirties and forties may be more willing to take risks with higher-interest rates due to their experience. Those over 60 tend to have a lower credit risk as they are more likely to pay off loans on time. Thus, when it comes to good-paying borrowers, financial institutions should look towards early boomers and those in their thirties or forties, as they offer the best long-term investment potentials thanks to their financial stability and willingness to take risks.

The 2019 Financial Inclusion Survey also revealed that loans increased for both males and females, but more so for men, whose incidence nearly doubled from 15% in 2017 to 29% in 2019. And based on our research, which is a preview of our white paper, Filipinos typically apply for loans due to personal needs or to support their families.

On the contrary, younger generations, such as Millenials, might present a greater credit risk due to student loan debts and lack of experience.

People in the credit risk field must be aware of this data to assess creditworthiness better and reduce high percentages of non-performing loans. Understanding each generation's different credit risk profiles will make it easier to determine loan decisions and take appropriate measures to minimize losses.

Reasons for credit risk among different generations

Credit risk is the potential for a borrower or counterparty to be unable to meet its obligations following agreed terms. Credit risk can have both direct and indirect impacts on an organization.

The direct impact of credit risk may include losses from default or late payments on a loan, related interest or fees, and write-offs of bad debt. On the other hand, the indirect effects may include increased capital requirements, which can result in higher borrowing costs and lower liquidity if lenders become wary of extending credit.

Credit risk occurs when lenders lack further assessment for creditworthiness. Particular individuals are good-paying borrowers as long as they have a source of income, and younger individuals may find it hard to pay their debt since they don’t have a stable income.

To simplify, credit risk happens when lenders need more data to assess their customers.

How Smile can save lenders from credit risk regardless of age/generation

To mitigate credit risk, financial institutions can employ strategies where they can evaluate the creditworthiness of potential borrowers. This can be through extensive background checks and financial analysis, diversifying their loan portfolios by minimizing overexposure to any borrower or type of asset class, and establishing sufficient recovery mechanisms to cover any losses incurred.

Financial institutions must consider all factors to assess creditworthiness accurately and ensure healthy loan portfolios. Keeping up with customer demands provides an improved lending experience while keeping potential risks at bay.

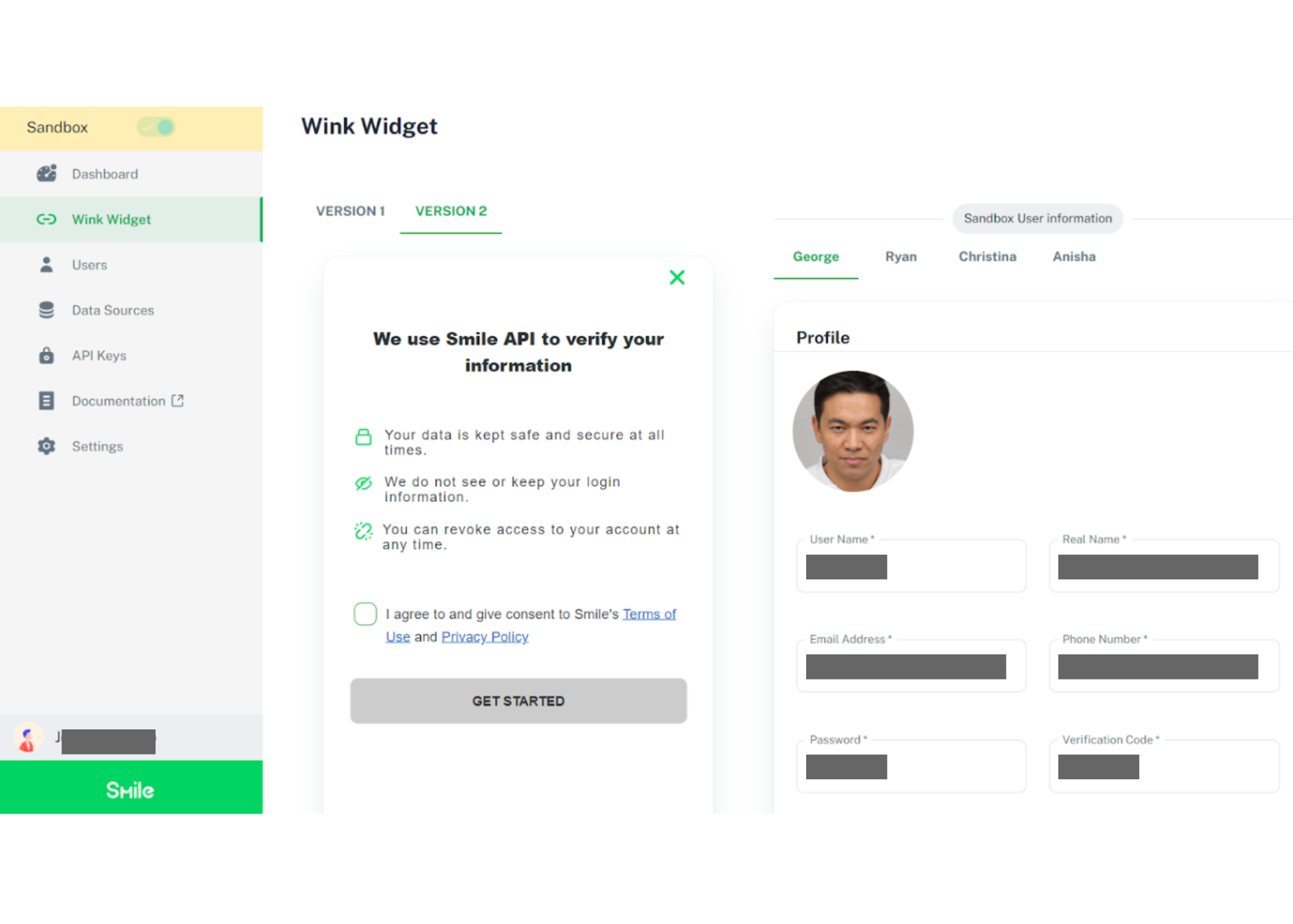

Smile API is here to provide user-authorized access to the most recent, comprehensive, and verified employment data. This is a game-changer for lenders because these data include employment documents, HR and payroll systems, and gig economy platforms.

This is why lenders should try our product in the developer portal, so they can better understand the nuances of different age groups regarding loan applications and know how best to manage their credit risk.

With our product, lenders will be able to develop a more comprehensive approach to managing credit risk and ensure that they are lending responsibly while still providing borrowers with loan options designed for them. Book a demo with Smile API today!