Corroborating multiple types of information such as identification cards, proof of billing, certificate of employment, and pay slips have been used to assess borrowers’ credit worth for the longest time. However, underserved sectors such as gig workers do not have access to such paper documents.

Recently, BSP is encouraging banks and other financial institutions in the Philippines to use alternative data to cover underserved sectors like gig workers or freelancers. Alternative data may mean borrowers’ telecommunication data, bank statements, web behavior, and social media data.

All of which may be used to assess credit worthiness. Despite its usefulness, how reliable can alternative data really be?

How this impacts credit risk managers

Credit risk managers have a crucial role in loan approvals because they set the standards for who good-paying borrowers should be. Alongside credit risk managers are loan operations specialists executing the standards set for ideal borrowers.

The traditional way to collect data requires a lot of paperwork and is time-consuming, not to mention that there is a chance for documents to be outdated. Here is why the Banko Sentral ng Pilipinas is pushing alternative data.

Using Alternative Data for Credit Scoring

By combining alternative data with traditional practices, lenders can have a broader and more comprehensive view of a borrower’s ability and willingness to pay.

Telecommunication data is one kind of alternative data that multiple lending companies are utilizing. They require borrowers to give their phone numbers when signing up and applying for online loans. The goal of using telecommunication data for credit scoring is to include the unbanked and underbanked population. With the new Mobile Number Portability Act (MNPA) or RA 11202, Filipinos can keep their number regardless of changing couriers and keep all their telco data for lenders.

The MNPA is most beneficial to lending companies because they can refer to a borrower’s “texting usage, data usage, voice usage, top-up patterns, and SIM age” when assessing loan applications.

Another widely used alternative data source is device data and web behavior. Because loans are now accessible through OLAs or online lending applications, more and more smartphone users are able to apply for and receive loans. Using device data and web behavior is an opportunity to cover people with low financial credit literacy because they might not have the usual documents for loan applications.

Bank data can also be used as alternative data for credit scoring. It should reflect in their financial transaction behavior that they are a good-paying borrower. Bank data can refer to bank statements, account balance, borrower’s income, and spending behavior. This alternative source directly indicates a borrower’s capacity to handle money, which can help lenders predict their attitude once a loan is approved.

But why is it not enough?

Alternative data sounds too good to be true, and it just might be. Like any other thing, there are limitations to using alternative data for credit scoring and risk assessment.

Telecommunication data, despite its convenience, may be inconsistent with the results it produces. As texting and data usage behavior changes or fluctuates over time, it is hard to use this as a reference for a user’s borrowing behavior. The shortcomings of this alternative data source do not mean that it is useless; it just means that there are more reliable sources that are more appropriate for credit scoring.

Device data and web behavior, like telecommunication data, fluctuate over time. Using this alternative data source may not give the best data results because this does not entirely cover a borrower’s spending capacity or borrowing behavior. Additionally, one account or device may be shared with several people, which means that the data processed from that account will not reflect only one person’s web and device behavior.

In the spirit of serving the unbanked, bank data is not inclusive. Financial inclusion aims to give underserved sectors the same opportunities as those who are more financially literate. As bank data means information gathered from bank accounts–including spending behavior and account balance–the unbanked are immediately disqualified, which is counterproductive.

Smile API’s Solution: Access to User-Authorized, Verified, and Recent Employment Data

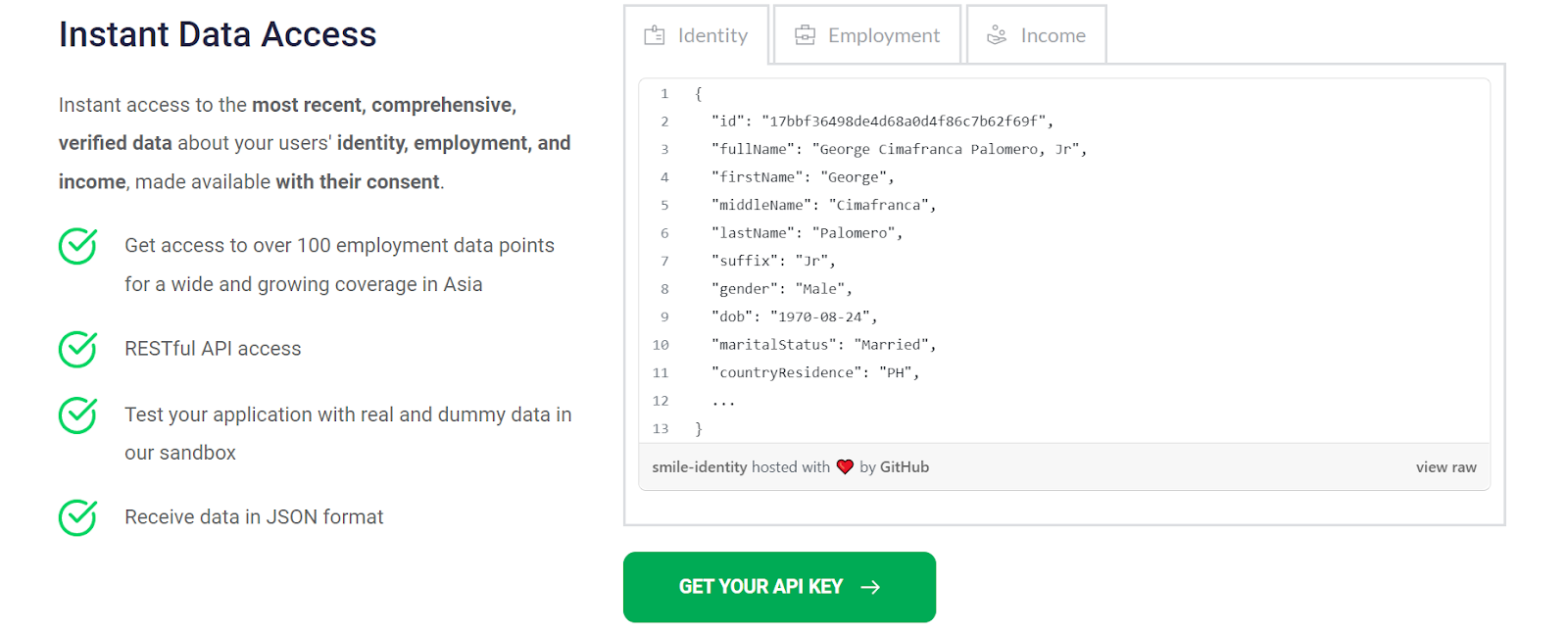

Smile API is bringing the solution to the shortcomings of alternative data: utilizing verified employment data for credit scoring.

The difference between using employment data and alternative data boils down to reliability. With Smile’s API, employees can give access to their data from direct sources like SSS, GSIS, BIR, HR systems, and gig economy platforms for loan operations specialists to fast-track loan applications. This API also makes it easier for lenders to verify borrowers’ identity and income data, which saves time compared to traditional data collection processes.

Alternative data can only take you so far, not to mention it can be complicated to process. This API is easy to use for both users and lenders. Smile and its users–both borrowers and lenders–are one team; it serves as a bridge between the two users by providing a channel where they can share user-authenticated data and receive the data in real-time.

Smile API can be the solution to your long-time problem with processing loans.

For more accurate credit scoring in your future loan application processing, sign up on our Developer Portal now.