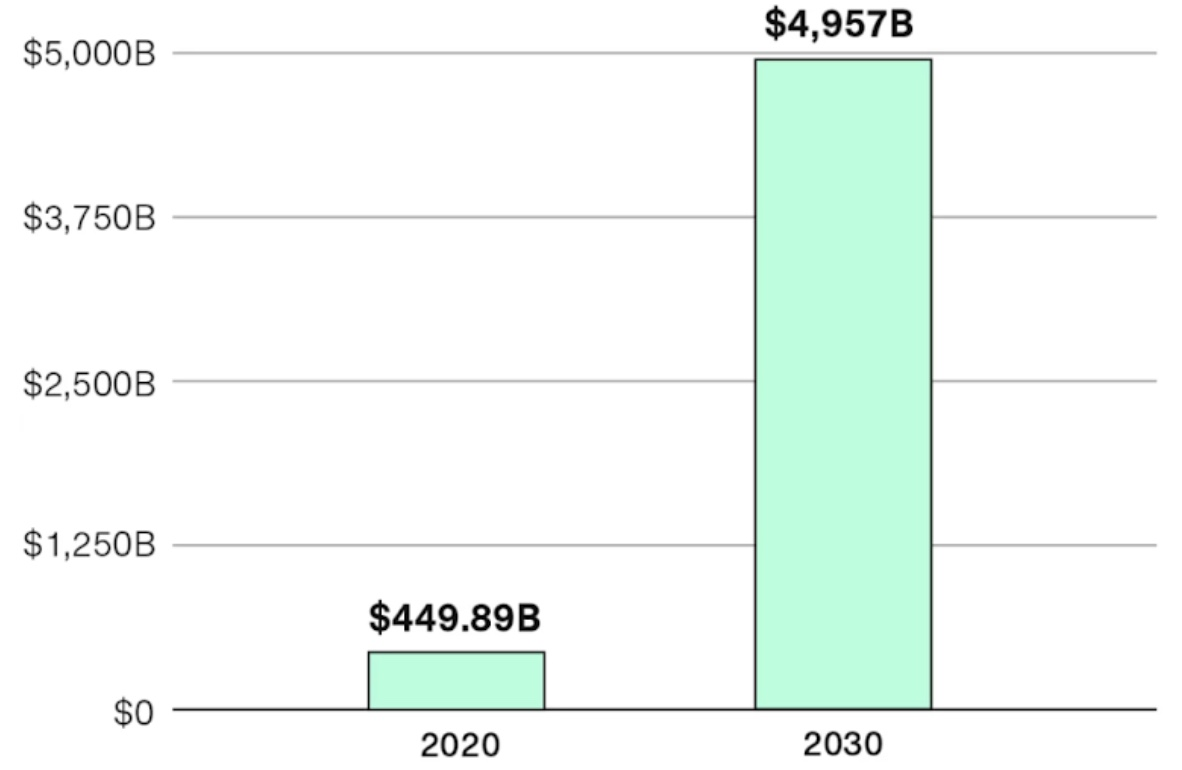

Fintech lending has been one of the most profitable industries in the 21st century. In 2020, its market was valued at $449.89 billion and is projected to grow at $4,957 billion—a compound annual growth rate of 27.4 percent. However, with uncertain times, lending companies must adjust their practices to protect themselves from economic fluctuations, interest changes, and market volatility our world is experiencing today.

2020 fintech lending statistics and 2030 projected growth

Risk-based Pricing

Lending companies and banks can prevent their company from approving delinquent payers by adjusting their loan terms and/or interest rates based on the perceived risk of the loan applicant. Usually, higher-risk loans correspond with higher interest rates.

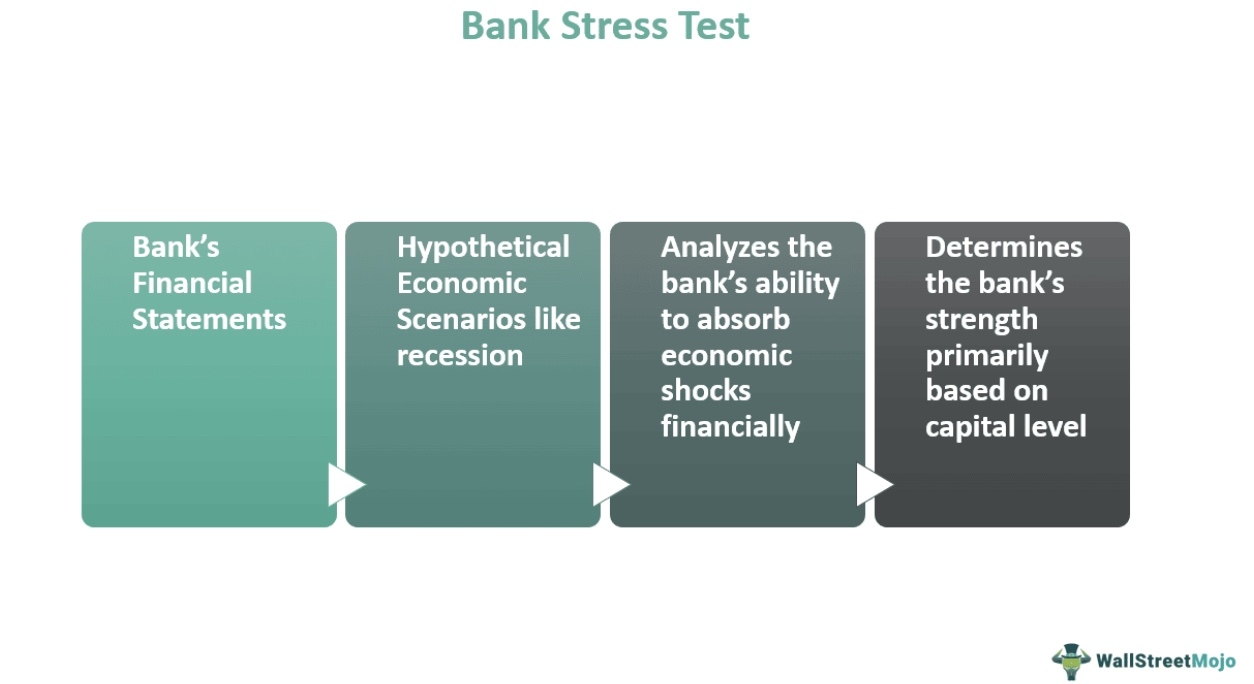

Stress Test

Stress testing has been a practice in the financial industry to test whether an individual, a company, a system, or any financial institution can withstand different economic scenarios. This could enlighten a company on whether a loan applicant has vulnerabilities that could be given solutions, or if these flaws could not be mitigated.

Bank stress test

Loan Diversification

Diversifying loans across different individuals, sectors, and industries with various risk profiles entails lower risk if a particular sector experiences economic downturns.

Planning Strategically

Having strategic plans ahead of time for different economic scenarios can save a company a lot of money in the long run. Creating contingency plans for recessions, worldwide health crises (such as a pandemic), and other economic downturns will greatly help the company in making crucial decisions for the organization.

Diverse Sources of Funding

Different funding sources such as bonds or deposits can help ensure the stability of funds in a company. Just in case a single source of funds is disrupted when the market is volatile, the company will always have a backup.

Proper Communication with Borrowers

Communicating with borrowers regularly not only ensures that a borrower will pay on or before the due date, but also establishes their trust in your company. This also promotes transparency, in case they have some trouble in paying the loan, you can offer them solutions that will benefit both them and your company (e.g. refinancing, modification in the loan, etc.)

Third-party Protection

In case a borrower is going through financial hardship and is unable to pay the loan, another solution is to offer third-party services such as coverage, insurance, extended warranty, etc. This protects the company and the borrower and relieves the latter from additional anxiety during their personal financial crisis.

Bankassurance is one example of third-party protection

Strong Loan Underwriting Standards

Lending companies and banks can strengthen and revise their requirements in loan underwriting to ensure borrowers are capable of paying their loans with minimal to no problem. Ways to strengthen this include approving applicants with good credit scores, having a history of being a good payer, and stricter income verification, among other standards.

Economic uncertainty will always be a risk factor for many lending companies and banks, especially in the fintech industry. It is crucial to ensure that borrower is capable of paying their loans based on their employment and income data, assets, and liabilities.

With Smile API, companies can verify this information and more through a centralized, real-time data source, all with the borrowers' consent. Smile makes the verification process efficient and cost-effective, streamlining the process for both the company and the borrower. After all, ensuring that both the company and the borrower are satisfied should be the number one priority.