It's been another productive quarter at Smile API, and we're excited to share all the new features and improvements we've made to our platform.

In this article, we'll outline each of the major product updates released in Q3 2022 and shed some light into improvements and fixes we've made under the hood to make sure we deliver the best value for customers and end-users alike.

Highlights of Q3 2022

The product highlights for 2022's third quarter include:

New APIs:

Estimated Incomes API

Liabilities API

Account Revoke API

Wink Widget improvements:

Provider focus and deeplinking

Widget streamlining

Error handling and webhook improvements

New Developer Portal features and improvements:

Visual Curriculum Vitae (CV) view of user data

Data Points Explorer

User Search

Documentation improvements:

Chinese Translations for API Reference

Product Overviews and Guides

We'll go through each in more detail below.

New APIs for Access to Better Data

We've released new APIs to help you discover and use information from the data sources your customers choose to share with you.

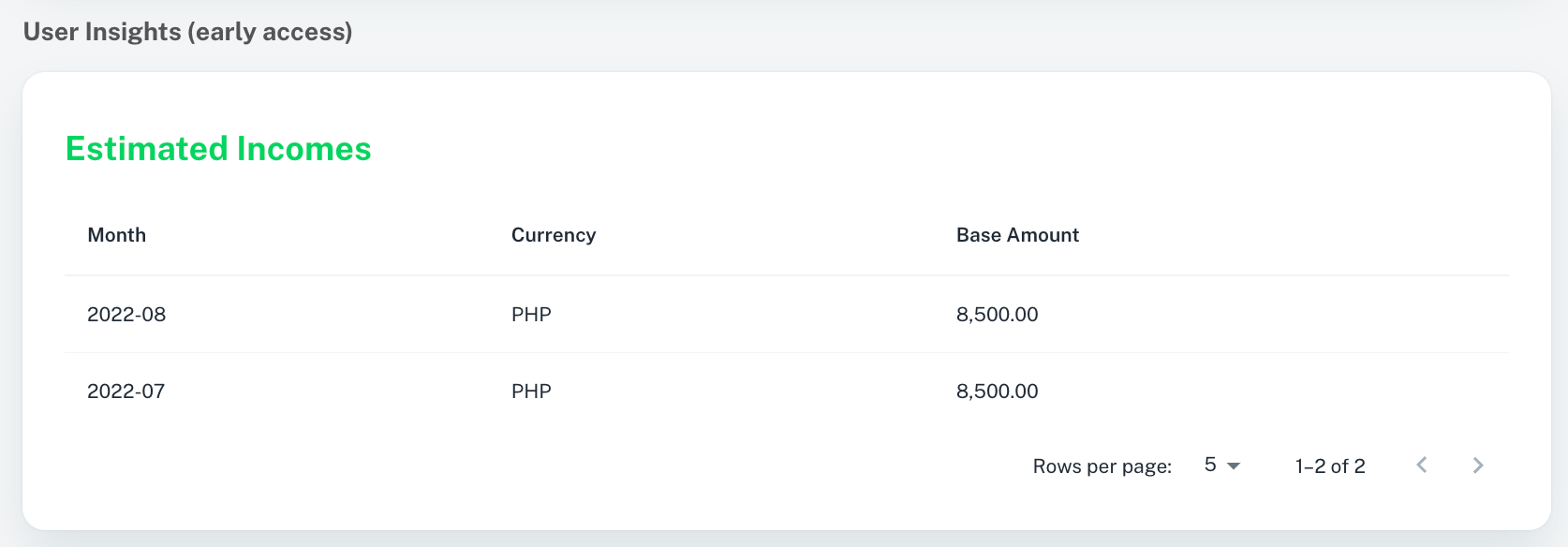

We've released the Estimated Income API, which provides an estimate of a person's current monthly income based on verifiable government-mandated contributions to social security and national health agencies. This API is currently in early access, which means that it may change before it becomes generally available.

Aside from estimates from contributions, we also surface estimates from alternative income sources that users may choose to share with financial institutions to further strengthen their credit worthiness. These income estimates from transactions on gig platforms are especially helpful when targeting the underbanked and gig economy workers.

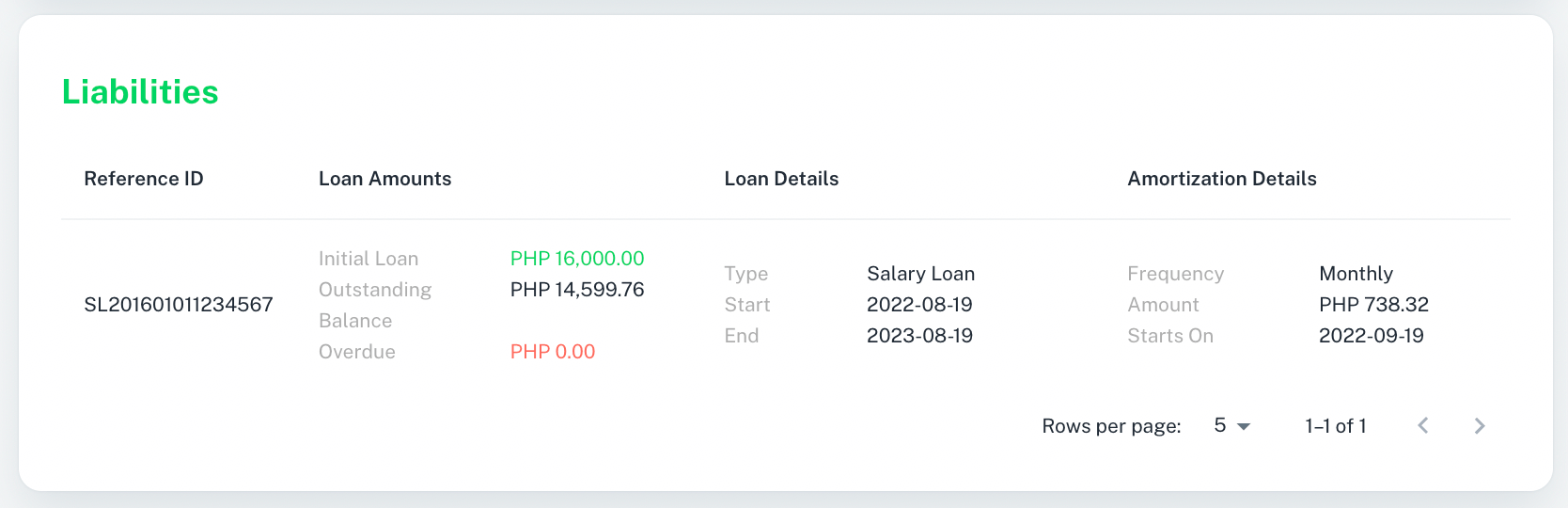

We've also started rolling out the Liabilities API this quarter, which provides information on your user's loans if they choose to share this data with you.

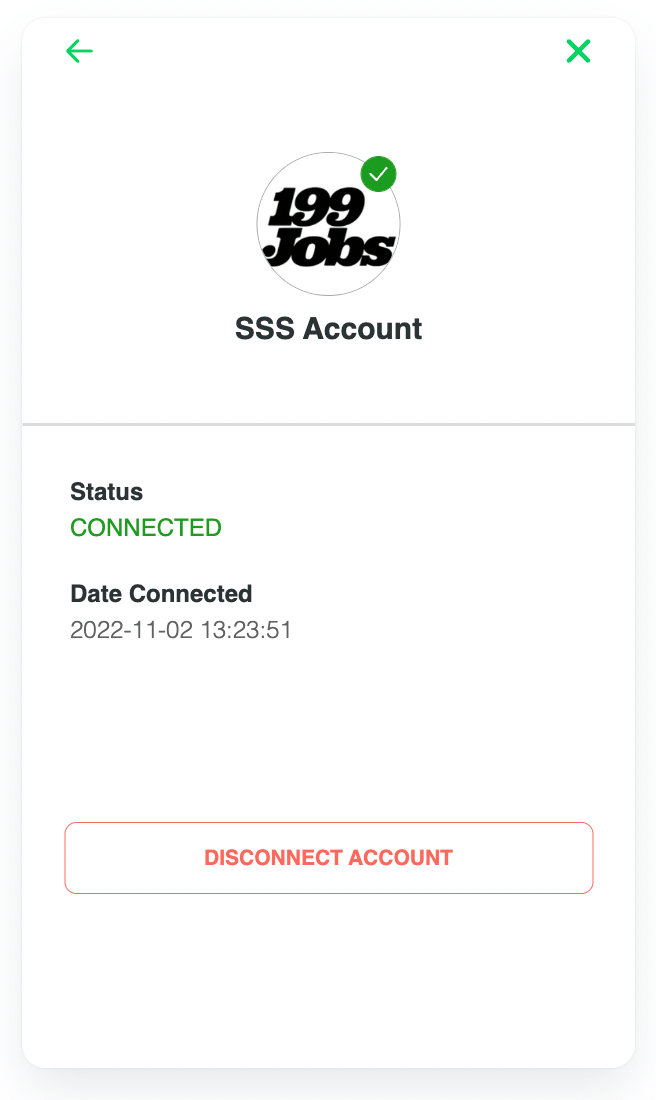

Lastly, making sure that end-users have full control of their data, we have also released the Account Revoke API, which allows users to completely revoke access to an account they have previously connected.

The Wink Widget SDK also automatically allows end users to revoke connected accounts. All account data is then removed from our system.

Wink Widget SDK Improvements

We've approached our Wink Widget with the mindset that it should meet financial organizations' requirements, ensure user experience and safety, and be as easy and quick to implement as possible.

Aside from ensuring that users may revoke accounts easily to maintain control of their data, we've improved user experience with the display and presentation of our SDK's terms and conditions and privacy policies. Legalese are now shown within the SDK instead of being linked out, ensuring users won't feel threatened by unexpectedly being thrown out of the process of sharing their data to you.

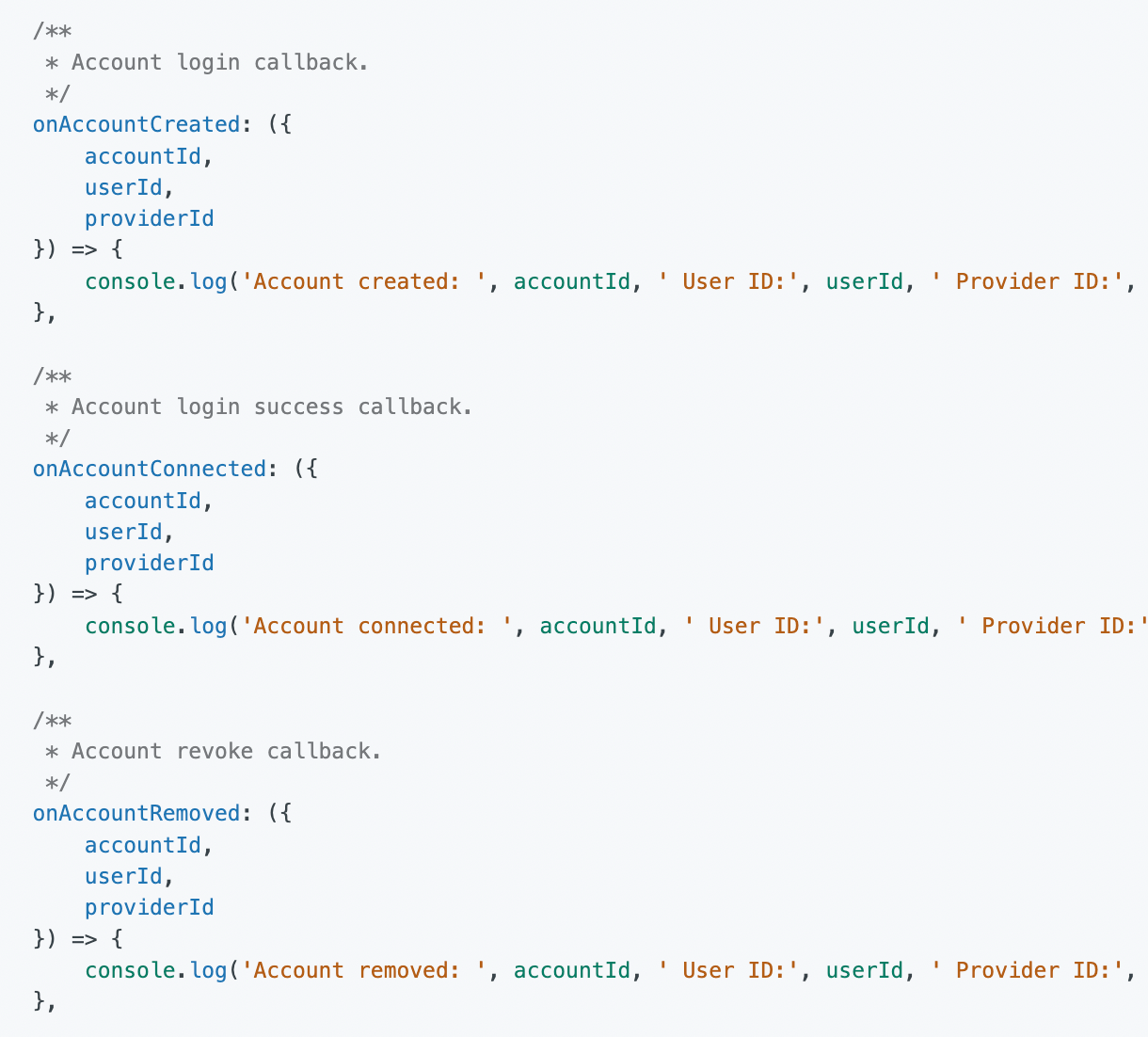

We've implemented additional callback functions for more robust error-handling and catching, as well as ensuring you get notified of pertinent user data information through our available webhooks.

Aside from adding webhooks for our new APIs, we've included webhooks for account locked events, and adopting an "at least once" delivery guarantee for notifications.

Our SDK can now also pre-filter providers according to your requirements, if you wish to limit the data sources your users choose to share with you.

New Developer Portal Features

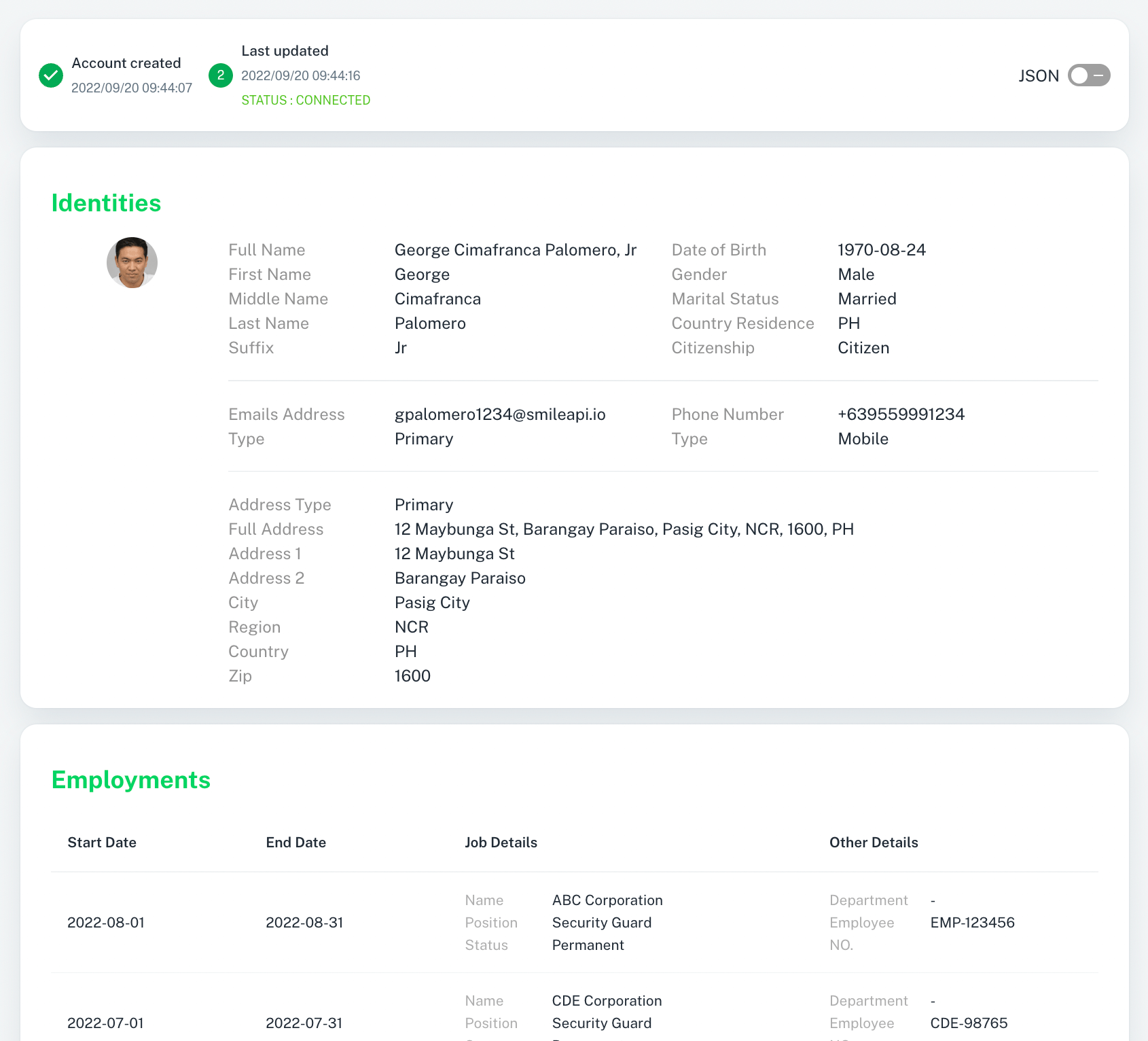

Our biggest update this quarter for the developer portal is the inclusion of a CV view of user data alongside the JSON formatted view. This makes it easier for both developers and risk professionals to quickly skim information that their users have shared with them, without the need for extra development.

An additional user search and filter also helps with managing the influx of user data into your system.

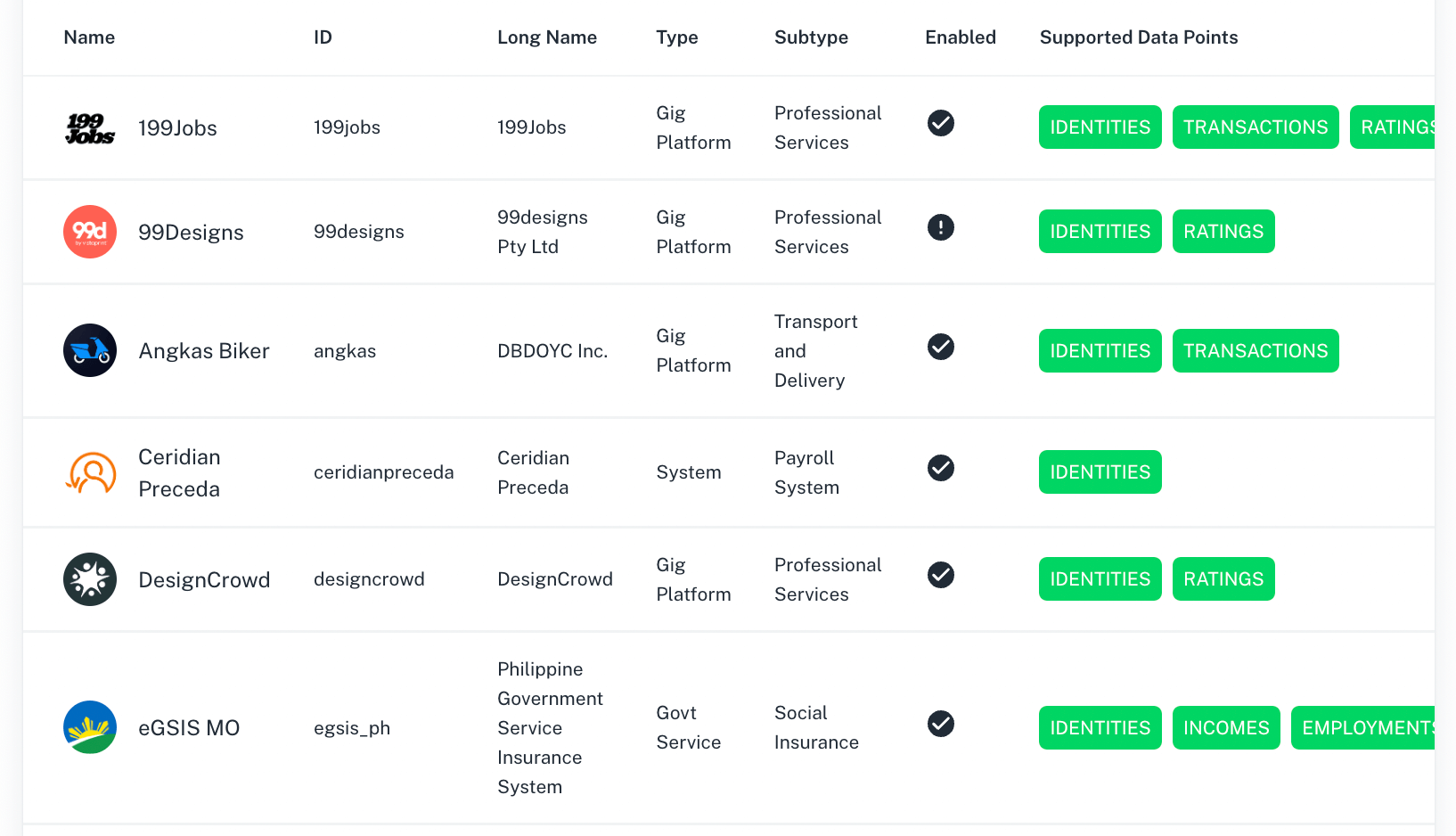

We've also introduced the Data Points Explorer in the Developer Portal, which allows developers an easy way to check what data points are available from each data source without having to look through documentation or send test calls to the servers.

Additional Improvements

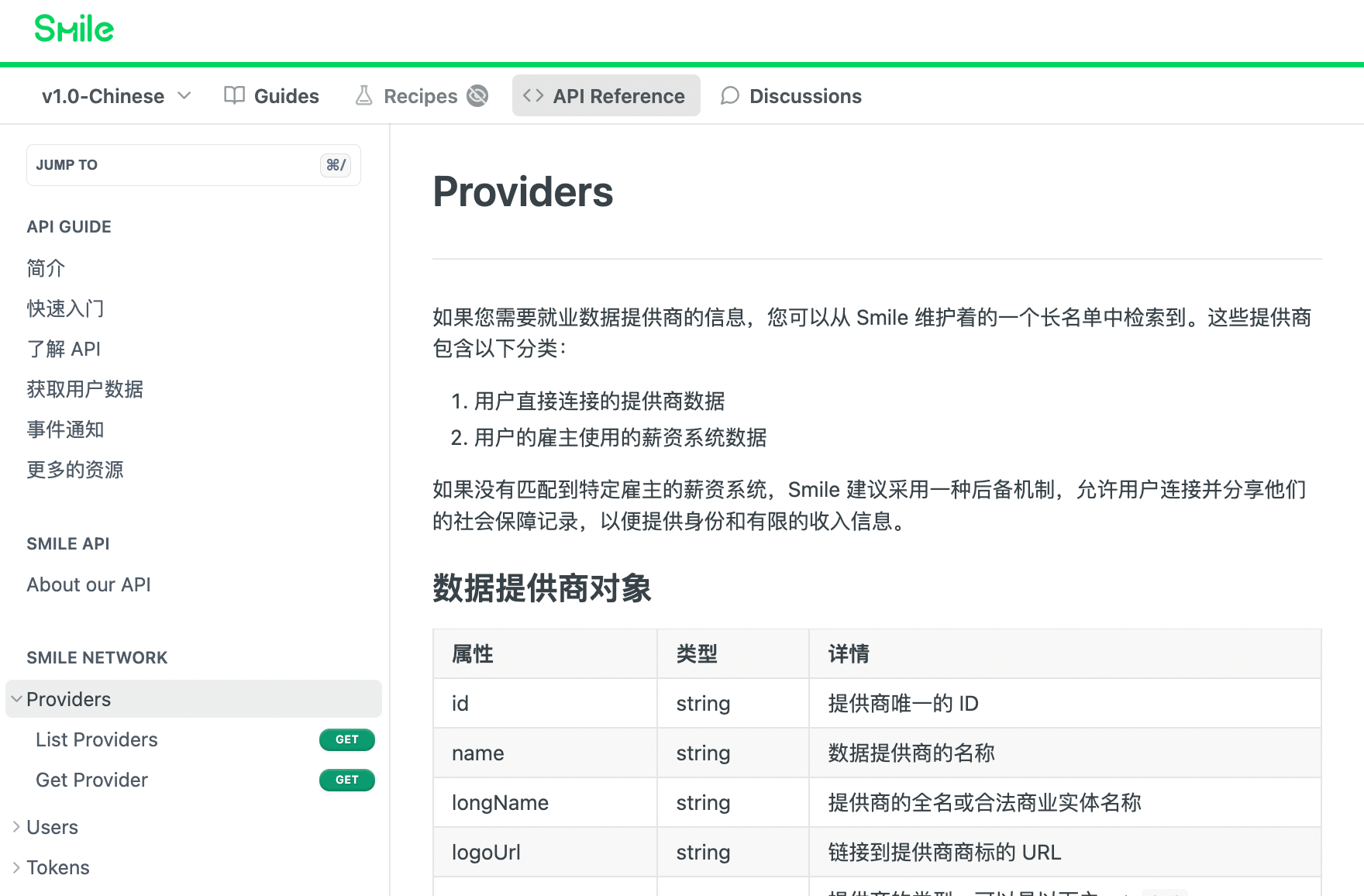

We've released the Chinese translation of our API reference, as well as fleshing out available Guides for our APIs. We will continue to release documentation updates and guides to ensure developers will be able to quickly get on board developing with our SDK or from scratch.

We've also worked with numerous improvements under the hood, such as in the way we present data on the developer portal, additional normalization and standardization on the raw data from data providers.

Final Thoughts

This third quarter of 2022, we've focused on building out our platform according to market needs and customer feedback. We've listened to the need for reliable normalization and ease of ingesting our data, as well as expanded data to ensure we can support credit decisioning and underwriting processes that are important for the market.

We've also turned a critical eye on user experience and safety this quarter, and aside from the numerous improvements we've released the past three months for the Wink Widget SDK and the Developer Portal, we're excited to continue this trajectory with you in the coming months of 2022.

We'll continue to work on building out our platform with the goal of making it the most intuitive and easy to use API in the industry. Thank you for your continued support!